How private equity investors build value through a coherent plan for biodiversity

When it comes to the environment, most private equity (PE) investors are still focused on decarbonisation, but a growing number are thinking about their portfolios’ interface with nature. Some have even embarked on the assessment process recommended by the Taskforce on Nature-related Financial Disclosures (TNFD), to screen and prioritise their most material impacts and dependencies on nature. There is a significant appetite for learning about how nature targets can create value by realising efficiencies and mitigating risks, and responsible investment leaders have begun to build the value-creation case for climate and nature.

These are some of the encouraging trends The Biodiversity Consultancy observed at the Responsible Investment Forum organised by Private Equity International (PEI), where we hosted a workshop: “Building a coherent plan for biodiversity”.

We believe that PE investors are in a better position than public-market investors to understand how nature is material to their portfolios. This is because PE investors have better access to data that allows them to assess how and where their portfolio companies depend on natural ecosystems. This also means PE investors are better able to capitalise on nature-related opportunities to create value.

Why does biodiversity matter?

However, even though biodiversity is starting to appear on the investment agenda, most investors are still in the early stages of understanding why it matters. To begin with, it is important to know that biodiversity — which refers to the diversity of all life on Earth — is only one part of the natural world, which also includes the non-living aspects of nature, such as the climate, water, and soil. The world economy is embedded in nature, with more than half of global GDP directly dependent on nature and its services (also known as “ecosystem services”, such as pollination, climate regulation, and water filtration).

Biodiversity underpins the resilience of nature but we are experiencing a drastic loss of biodiversity around the world, due to 1) land- and sea-use change; 2) resource exploitation; 3) pollution; 4) invasive species; and 5) climate change. These five drivers of biodiversity loss are environmental themes that many investors are familiar with, but they may not have considered how they are related to biodiversity and the ecosystem services that businesses depend on. For example, hydropower dams often suffer from silting which reduces power output, and this is significantly worsened by soil erosion from deforestation and land conversion, which also impact biodiversity due to the loss of natural habitat.

As for climate change, it is worth noting that climate adaptation and nature dependency are often inter-related. Both are very location-specific, and a net gain in biodiversity often increases resilience to climate change. In agricultural value chains, for example, agroforestry techniques can lead to improved soil quality and shade cover, and this not only increases resilience to soil erosion and drought, but also benefits biodiversity.

In short, biodiversity impact and dependency are more than just about protecting endangered species and preventing deforestation. Investors will find that their existing expertise in themes like circular economy can be read directly across into the mapping of biodiversity and nature-related exposures. At the same time, banks and institutional investors are starting to grapple with the materiality of biodiversity risk and opportunity, including the identification of new investment opportunities to support the transition to nature-positive outcomes.

‘Double materiality’ helps reveal nature-related risks

This dual relationship between companies and nature is called “double materiality”, which comprises company materiality (such as when the availability of water is financially material for a mining company) and impact materiality (for example, when a mine causes water pollution, which may be material for the planet).

A double materiality approach can reveal surprising and unexpected ways in which finance is exposed to nature-related risks. As part of the global effort to push businesses to assess and disclose such exposures, the European Union has mandated double materiality reporting on sustainability issues for large corporates listed on EU-regulated markets, through the Corporate Sustainability Reporting Directive (CSRD).

However, assessing nature-related risks is new to most businesses, and requires the bringing together of many unfamiliar types of data, tools, and assessments. This is why the TNFD has recommended a set of voluntary disclosures, as well as a framework known as the LEAP process that corporates and financial institutions can follow.

The LEAP process stands for:

-

Locate your interface with nature

Where does the interaction occur? For example, it could be a water source.

-

Evaluate your dependencies and impacts

What is your relationship with nature at the interface?

-

Assess your risks and opportunities

What does the current state of nature, and your relationship with it, at the interface, mean for your business? What risks and opportunities does the current situation pose?

-

Prepare to respond and report

To put it simply, LEAP is a structured process for assessing and reporting an organisation’s relationship with nature. It is important to keep in mind that the overall objective is to help corporates and financial institutions prioritise action on their nature-related exposures — and in this regard, some may find LEAP to be insufficiently prescriptive. For example, what exactly are the actions that businesses should take after each step?

Use TNFD’s LEAP approach to prioritise action

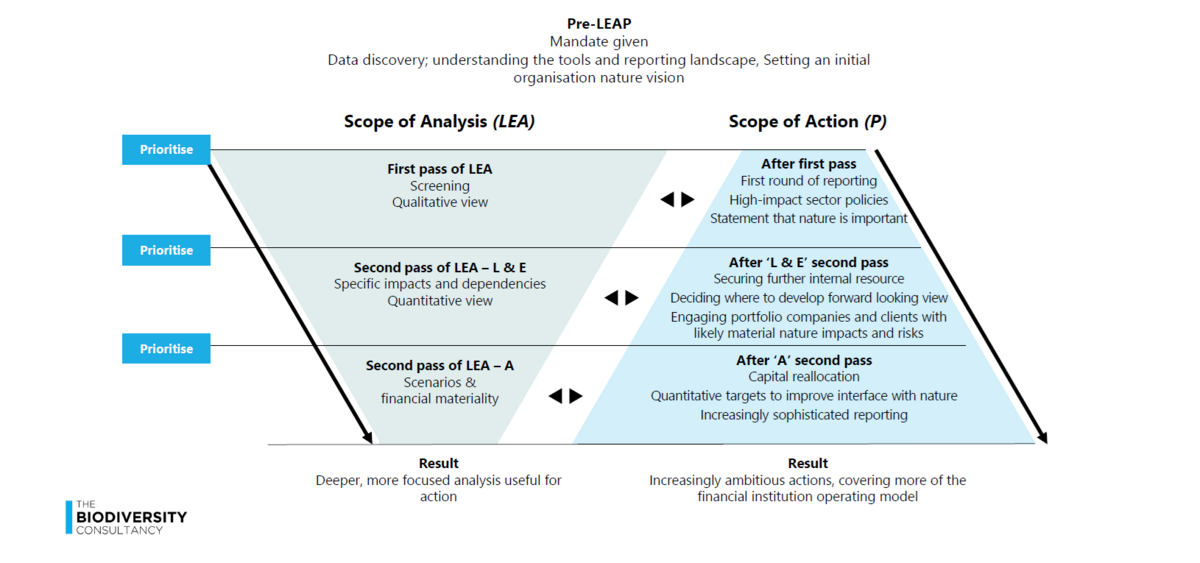

Here is an approach to LEAP that may be better tailored to PE investors:

Essentially, we recommend using multiple passes of the LEAP process to prioritise engagement and deeper analysis with the parts of the portfolio for which nature is most material. The process can progress from a high level, sector-based analysis of likely level of risk, to gradually incorporate more specific company data as you identify and focus on sub-sectors of the portfolio with specific risk and opportunity exposures. This enables an efficient allocation of effort and meaningful engagement with companies for whom the issues are material, rather than a blanket approach that doesn’t add value. In our experience, once the companies for whom biodiversity is a material issue are identified and engaged, they are generally grateful for the support and insights because they are aware it is something that they need to manage, but often haven’t known where to start, so they see it as value adding.

- The first pass, involves screening for material impacts and dependencies (in alignment with steps L, E, and A of the LEAP process) across the whole portfolio, to provide a qualitative view of hotspots of risk and opportunity exposure. The results would inform the scope of action (in alignment with step P of the LEAP process). These follow-up actions could include producing a summary report of portfolio-wide nature risk and early engagement with relevant companies to understand their current level of awareness of the risk.

- The second pass is a deeper dive into specific impacts and dependencies for a relevant sub-set of the portfolio (focusing on steps L and E of the LEAP process), integrating company specific data, for example gathered during due diligence, annual monitoring integrating company-specific data, for example, gathered during due diligence, annual monitoring or a questionnaire. This step is important to ground the sector-based analysis in the realities of the operations of the individual businesses. PE investors will find they often have more relevant data than they realise. For example, one of the material impacts and dependencies for many businesses is around water use, which is data that is often already collected as part of ESG reports. If location-specific information is available, you can also start to identify which of the companies’ sites are exposed to the most risk, e.g. by being high water users in a water-stressed area or due to developing new infrastructure near an area of high biodiversity. Identifying what key raw materials the business relies on, and whether these are highly dependent on ecosystem services that may be at risk of collapse is also useful at this stage. With these insights, you have the information to start a focused and meaningful engagement with portfolio companies, based on their specific risks and opportunities.

- During the second pass, investors can also construct scenarios and analyse the financial materiality of nature-related risks and opportunities in the portfolio or of specific companies (in alignment with step A of the LEAP process). The follow-up actions could include plans for capital reallocation, and quantitative targets for improving the investees’ interface with nature.

We have found this iterative approach to the LEAP process provides deeper and more focused analysis, while also producing a cascade of increasingly specific and targeted actions. It reinforces the connection between analysis and follow-up action, and helps investors avoid situations where analysis does not lead to concrete action.

Don’t lose sight of the end goal: To reduce nature-related risk and capitalise on opportunity in the portfolio

Above all, we help businesses and investors avoid the trap of reporting for reporting’s sake. It is vitally important to stay focused on the end goal, which is to take action to mitigate risk and add value through a better understanding of how biodiversity is material to the portfolio.

The nature crisis is urgent and is heavily interrelated with the climate crisis, particularly in terms of adaptation. Healthy, biodiverse ecosystems are more resilient to climate change and sequester more carbon; they are also better able to provide key ecosystem services such as regulating water flow to prevent flooding and ensure consistent water availability. It, therefore, makes sense to integrate an understanding of nature-related risk and opportunity into your approach to climate change rather than waiting until you’ve finished working on climate change before thinking about nature.

We would also like to point out that a variety of tried-and-tested tools exist to support the LEAP process. For example, TNFD’s ENCORE (Exploring Natural Capital Opportunities, Risks and Exposure) tool and the Science Based Targets Network’s (SBTN) Materiality Screening Tool are useful for screening and prioritisation, while tools like Life Cycle Assessment (LCA), Trase, and Forest IQ are useful for analysing transition risk exposure.

How we can help

At The Biodiversity Consultancy, we understand how businesses are exposed to nature risk, and we support our clients in analysing and developing a technical and yet actionable approach to mitigate and assess biodiversity impacts. We have enabled our clients to prioritise sites where risk and opportunities are most significant and help them add value to their portfolios.

We leverage more than 15 years' experience in supporting corporates to measure and manage their impact and dependence on nature, utilising nature data and science we are proud to have contributed to. If you're interested in learning more about how understanding biodiversity can add value to your portfolio, contact us at Contact Us - The Biodiversity Consultancy.

Categories: Financial Services, Insight

Where Business and Nature Thrive

Collaborate with us to deliver measurable nature impact.